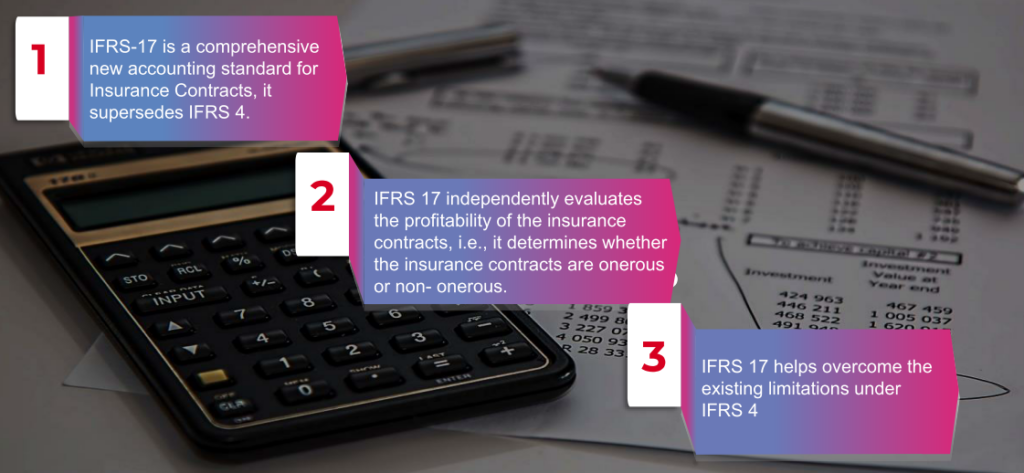

IFRS 17 is the newest IFRS standard for insurance contracts and replaces IFRS 4 on January 1st 2022. It states which insurance contracts items should by on the balance and the profit and loss account of an insurance company, how to measure these items and how to present and disclose this information.

This is a big change for insurance companies and data administration, financial presentation and actuarial calculations will need to change.

Why are IFRS 9 and IFRS 17 implemented together?

- The insurance liability (IFRS 17) is always closely connected to the financial instruments (IFRS 9) within insurers.

- When a client buys an insurance, the insurance liability is created and with the paid premiums are financial instruments bought.

- Insurers want to reduce the volatility in their earnings and there are some choices within IFRS 9 and IFRS 17 which they can make which can impact the volatility.

- Under IFRS 17 insurers can decide whether results of changing financial risk assumption go through OCI or through the profit and loss account.

- Under IFRS 9 insurers can decide whether changes in equity will go through profit and loss or through OCI.

Both standards will impact earning volatility and hence balance sheet management choices are connected. Consequently, the IFRS board decided it is better that insurers are granted the option to implement both standards together.

IFRS 9 explains the classification and the measurement of financial instruments. Hence IFRS 9 helps to improve the information disclosure around financial instrument. Many perceive the information disclosure around financial instruments during the financial crisis as inaccurate for example impairments on financial instruments were taken too late and the amounts were too little.

IFRS 9 makes the classification of each financial instrument more logical and principle based. There are two questions which need to be answered for the classification:

- Why is the company holding the asset; just for collecting the cash flows from the underlying asset, or is the asset also held for trading?

- What kind of asset is the financial asset? Is it a derivative, an equity or a debt instrument? With the SPPI (solely payment of principal and interest) model it can be tested whether an instrument is really a debt instrument.

The classification determines:

- which accounting principle is used;

- should the instrument be measured at fair value or at amortized cost

- and whether earnings and losses should go through the profit and loss account or through the OCI (other comprehensive income) account.

IFRS 9 also includes a more dynamic credit loss model instructing when an insurer should take an impairment on financial assets. The model is forward looking thereby also expected future losses should be taken into account with the impairment.

IFRS 9 also makes hedge accounting possibilities more rule based, thereby being in line with how risks are managed within insurers.

Why does this matter?

There is a huge impact on insurers and a big change in the disclosure.

- Almost all of the asset and liability side is hit by the combination of IFRS 9 and IFRS 17.

- New concepts and terms are introduced.

- The standards will impact the presented numbers. Under IFRS 17 the insurance liability needs to be based on updated assumptions which is not currently a requirement. .

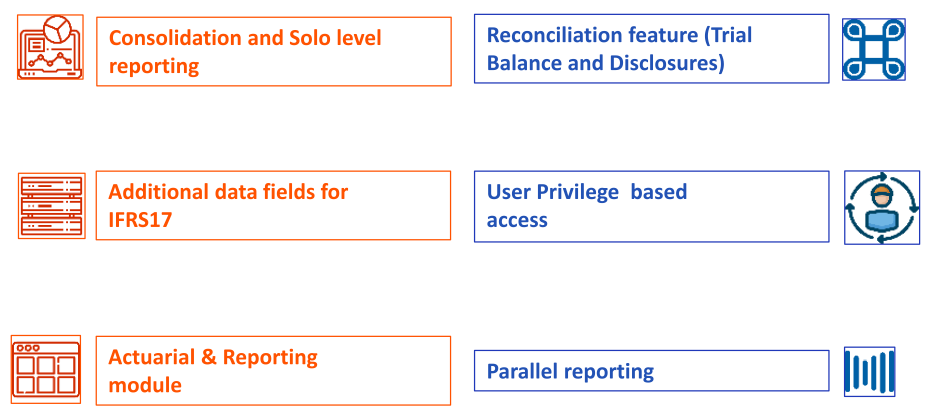

- More data with more granularity and more history will challenge internal data storage, reporting and IT performance.

- Reporting timelines are shortened, which will challenge the systems, and the cooperation between different departments.

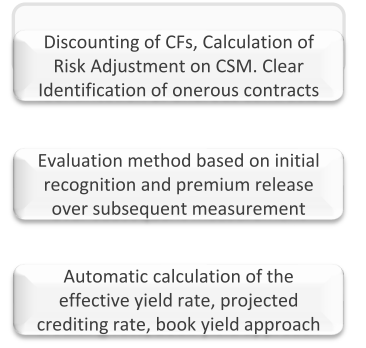

- New components like the unbiased Cash Flows, Risk Adjustment, Discount Rate and CSM are introduced. This means the insurer needs to understand the IFRS 17 principles and decide how to implement IFRS 17. For example which measurement model to choose for an insurance product, which transition measure to user. Read here more about the IFRS 17 model, and here about the transition period.

- In the balance and income statement, insurance liability will n be specified in a different way, the importance of gross written premiums will disappear, while equity will be impacted.

- The presentation of the balance and P&L are also significantly affected.

- Risk engines are needed to calculate the CSM and cope with all the different groups

- Insurers need to disclose information bases on group of contracts.

- A group is a managed group (often a product) of contracts which were all profitable, onerous, or may become onerous (decided at inception) with a certain inception year. Insurance companies can have hundreds of groups and IFRS 17 insists on this grouping to have more transparency as insurance companies cannot offset the result of one group to another

Synergy Software Systems has been implementing and supporting financial solutions in the insurance vertical for 25 years. If you need to rapidly implement a solution for IFRS 17 compliance that will sit alongside your existing erp and finance systems then call us on 0097143365589.