Asset leasing helps customers feel more confident that they’re following the proper accounting standards for ASC 842 and IFRS 16, reducing the risk of spending extensive time doing offline calculations. Asset leasing will reduce manual errors and save your users time through automatic lease status updates, right of use assets, wholistic monitoring and analytics, and calculations of net present value, lease interest, and future cash payments.

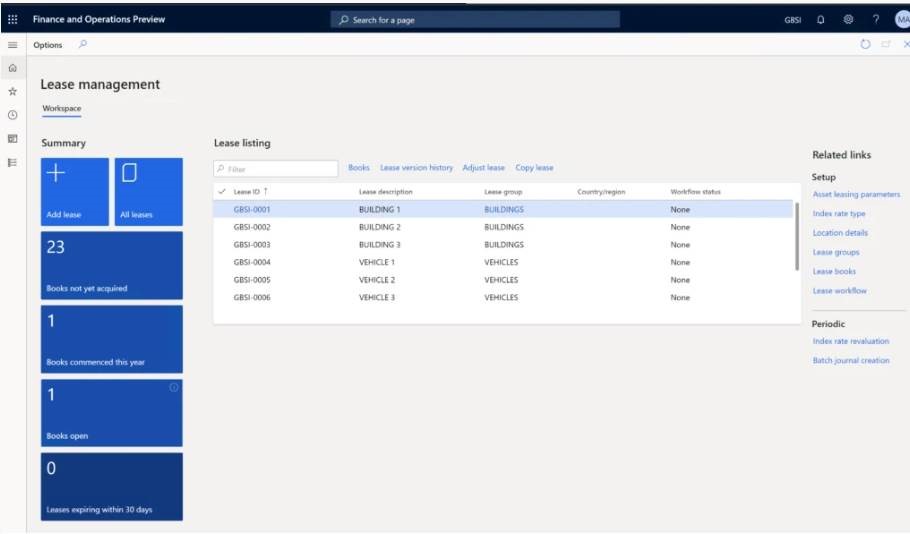

Dynamics 365 Finance > Asset leasing > Lease management

Asset leasing can help you with the following:

Automates the complex lease calculation of present value and its subsequent processes such as future lease payment, lease liability amortization, right-of-use asset depreciation, and expense schedules.

Automatically classifies the lease as either operating or finance, or as a short-term lease or low-value lease. The lease classification tests include transfer of ownership, purchase option, lease term, present value, and unique asset.

Centralizes the management of lease information, such as important dates, including the commencement and expiration dates, as well as the lease’s transaction currency, payment amounts, and payment frequency.

Helps to generate accounting entries for the initial recognition, and subsequent measurement of the lease liability and right-of-use asset.

Reduces time for complex calculation of lease modification and automatic adjustment transactions.

Provides posting to different layers to accommodate different reporting purposes, such as tax reports that are available in Dynamics 365 Finance.

Complies with the accounting standards to represent leases on a balance sheet using the Balance sheet impact calculator.

Provides audit controls over the integrity of the lease data to ensure that the posted transactions match the calculated amounts of the present value, future payments, and liability amortization.

Provides tools to import from or export to Excel for all lease data using data management.

Includes features that help in preparing asset leasing reports, particularly the preparation of disclosures and notes.

Integrates with company chart of accounts, currencies, fixed assets, vendors, journals, data management, and number sequences.

Asset leasing integrates seamlessly with other components of Dynamics 365 Finance, including Fixed assets, Accounts payable, and General ledger. Integrates with your company chart of accounts, currencies, fixed assets, vendors, journals, data management, and number sequences.

- Complies with the accounting standards to represent leases in balance sheets using the Balance sheet impact calculator.

- Provides audit controls over the integrity of the lease data to ensure that the posted transactions match the calculated amounts of the present value, future payments, and liability amortization.

- Provides tools to import from or export to Excel for all lease data.

If you need to comply with IFRS16 , or need assistance with implementation or support of Dynamics 365 Finance and SCM then contact Synergy Software Systems 009714 3365589.