Background

The UAE has long positions itself as a place where foreign investors are welcome and where incomes are tax free. Low taxes and a friendly business environment helped to transform the 50-year-old nation.

The UAE faces steep competition from neighboring Saudi Arabia, which is working overtime to attract businesses and families to relocate to the kingdom

The UAE’s Finance Ministry said that it will aunch corporate tax in line with worldwide efforts to combat tax evasion and to meet issues posed by the global economy’s digitization,

The ministry also stated that the measure will prepare for the implementation of a worldwide minimum tax rate, which will apply a different corporate tax rate to large multinationals that meet certain conditions.

It was announced on Jan 31 that for the first time, the United Arab Emirates (UAE) will establish a federal corporate tax of 9% on profits on business profits on June 1, 2023,

- Businesses engaged in the extraction of natural resources will be exempt from the UAE CT as such businesses shall continue to be subject to Emirate level taxation

- The UAE CT shall be a Federal level corporate taxation. Thus, all UAE businesses, corporations and entities engaged in and licensed to undertaken commercial activities shall be subject to the UAE CT.

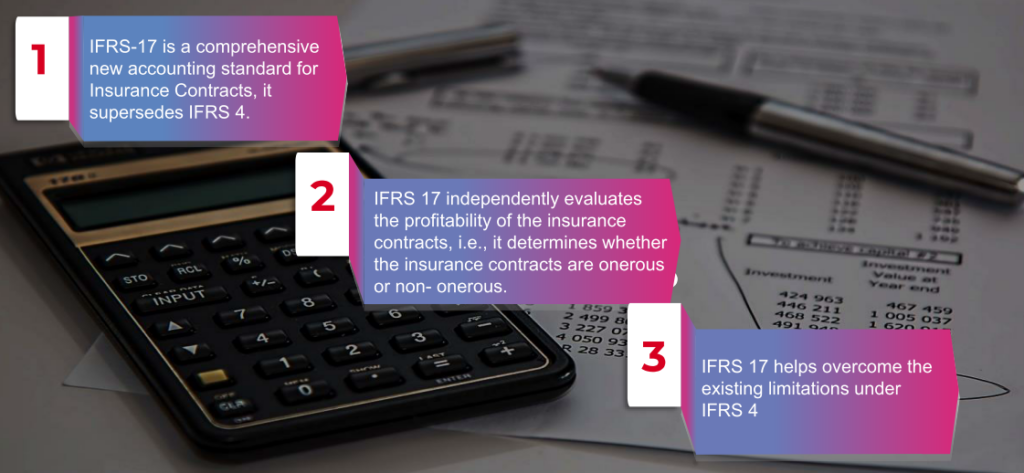

- Corporate tax will be payable on the profits of UAE businesses as reported in their financial statements prepared in accordance with internationally acceptable accounting standards “with minimal exceptions and adjustments”,

- The corporate tax will not apply to personal income from employment, real estate and other investments, nor to income earned from a business licensed outside the UAE.

Introduction of Transfer Pricing

Under the CT regime, UAE businesses will be required to comply with transfer pricing rules and documentation requirements as set out in the OECD Transfer Pricing Guidelines

Free Zone Businesses

Free zone businesses will be within the scope of UAE CT and required both to register and to file a CT return.

Those businesses will however continue to benefit from CT holidays / 0% taxation while they comply with all regulatory requirements and do not conduct business in mainland UAE.

Multinationals

The press release and FAQs indicate that there will be a different tax rate for large multinationals that meet the criteria under ‘Pillar Two’ of the OECD Base Erosion and Profit Shifting project (i.e. those that have consolidated global revenues above EUR 750m).

Tax basis

The Federal Tax Authority will be responsible for the administration, collection, and enforcement of CT.

Where a business is resident for CT purposes will be determined either based on the place of incorporation / registration (legal seat), or the place of effective management and control of the business.

To help small firms and entrepreneurs, the ministry further stated that the new system entails:

- a basic statutory tax rate of 9%,

- a 0% rate for taxable profits up to 375,000 dirhams, ( about $102,107.50 . )

CT will be payable on the accounting net profit reported in the financial statements of the business, with minimal exceptions and adjustments.

Tax losses incurred from the CT effective date can be carried forward to offset taxable income in future financial periods.

No UAE CT will apply to:

- Employment income, income from real estate, income from savings, investment returns and other income earned by individuals in their personal capacity that is not attributable to a UAE trade or business;

- Dividends, capital gains and other investment returns earned by foreign investors.

Exemption from UAE CT will be available for:

- Capital gains and dividends earned from qualifying shareholdings;

- Qualifying intra-group transactions and restructurings.

Domestic and cross border payments of interest, dividends, royalties and other payments will not attract a withholding tax in the UAE.

UAE CT will have to be filed electronically once for each financial period but without a requirement for advance UAE CT payments on the basis of provisional tax returns.

The tax scheme will allow UAE business groups to be taxed as a single entity or to apply for relief amid losses or restructuring. UAE group companies can form a tax group and file a single tax return for the entire group, and transfer tax losses to other members of the group.

Foreign tax credits will be available for taxation incurred by UAE businesses on income earned outside the UAE’s corporate tax to avoid double taxation.

The UAE CT regime should remain one of the most competitive in the world. The UAE will offer the most competitive CT regime in the region, with Egypt, Jordan, Kuwait, Lebanon, Oman, Saudi Arabia and Qatar imposing CT at rates between 10% to 35% (Bahrain currently does not have a broad based CT regime).

The introduction of a UAE CT regime would enable the UAE to adopt and implement the OECD BEPS 2.0 measures to address the tax challenges arising from the digitalisation of the global economy, and the introduction of a global minimum tax rate for large multinationals.

What next?

The relevant legislation for the CT regime is currently being finalised and will be subsequently promulgated. Once promulgated, the UAE CT Law will provide more details and guidance on several critical aspects.

Further information is expected to be made available by mid-2022, to give UAE businesses at least 12 months to get ready.

Key considerations for UAE businesses

To prepare for the new corporate tax (CT) profile of the UAE consider an internal working team and whether auditor discussions are needed

Consider the application and impact of the new UAE CT Law on :

- UAE entity(ies) and/or operations

- Revenue booked under Mainland UAE versus Free Trade Zone setups

- Economic substance profile and/or CbCR filings

- Group structure

- Inter-company transactions

- Investment/Holding structures

- Be prepared to adopt new tax and transfer pricing compliances (where applicable).

- Consider impact on share price and ability to raise finance

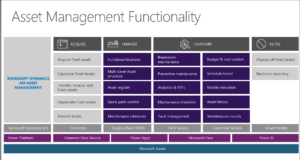

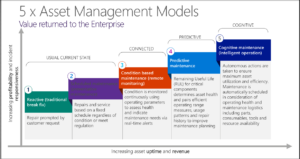

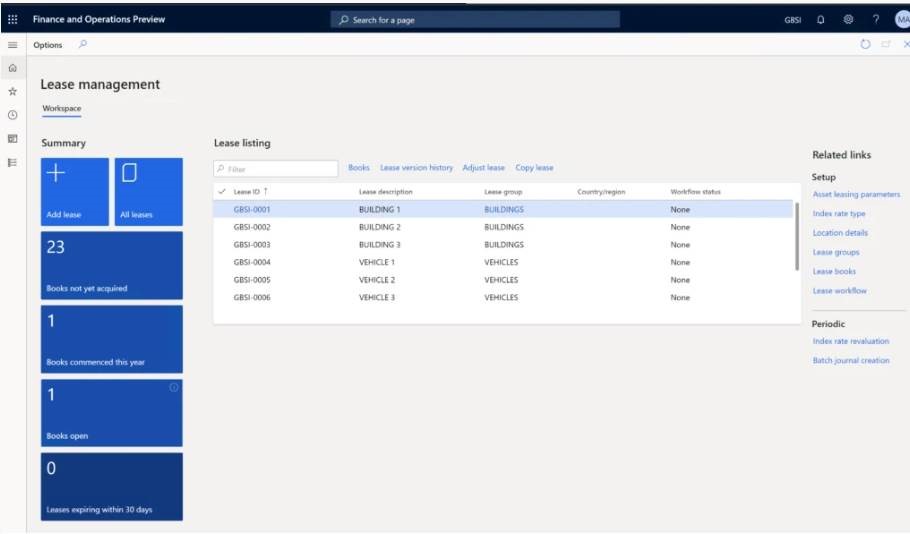

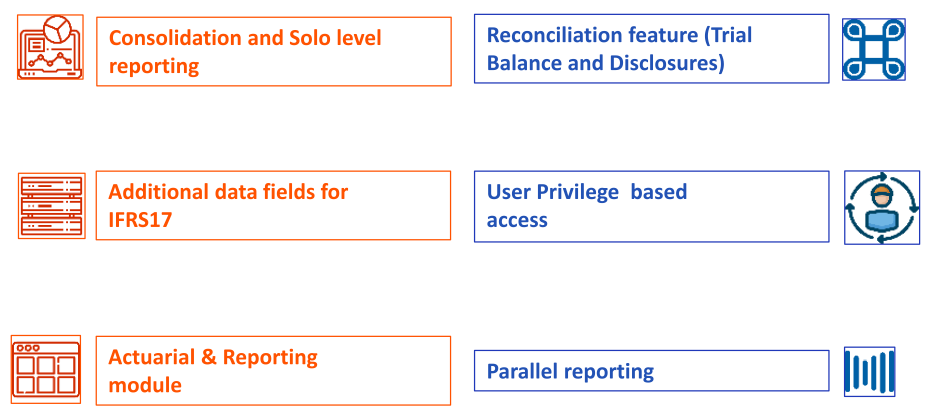

- Review IT systems and their configuration to support taxation, and budget for any external consulting resource to e.g. create filing returns reports, or to amend existing reports e.g. TB, cash flow.

- Consider whether there needs to be any changes to policies and training for the finance team.

- Consider a dry run pilot in a test system to ensure that you can produce timely accurate reports in the correct format.

(Most Dubai stocks fell in the Middle East on February 1 after the United Arab Emirates unveiled that it will be taxing corporate earnings from next year.

Moody’s said: “the introduction of the 9% federal corporate tax is broadly credit negative for domestic UAE corporates because it will reduce their operating cash flows.”)